Hsbc Sinaloa Cartel

The concept of money laundering is essential to be understood for these working in the monetary sector. It is a process by which dirty money is converted into clear cash. The sources of the cash in precise are felony and the cash is invested in a method that makes it appear to be clean money and hide the identity of the legal part of the money earned.

While executing the financial transactions and establishing relationship with the new clients or maintaining existing clients the duty of adopting sufficient measures lie on every one who is a part of the organization. The identification of such component at first is simple to cope with as a substitute realizing and encountering such conditions in a while in the transaction stage. The central bank in any country offers complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such situations.

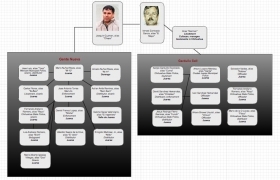

Prosecutors from the Justice Department pointed out that the significant amount of physical dollar bills that HSBC Mexico exports to the United States come from Culiacan the home of the Sinaloa Cartel Between 2006 and 2008 HSBC shipped more than 11 billion in dollar bills from Sinaloa. The decision was opposed by rank-and-file prosecutors who had prepared a list of up to 175 criminal charges against the bank that the government ultimately shelved.

Acts Of Terror Hsbc Faces Lawsuit Over Laundering Of Mexican Drug Money Rt Uk News

Murder femicide and kidnapping these are just some of the crimes mega-bank HSBC is allegedly complicit in by laundering dirty money from cartels like Sinaloa.

Hsbc sinaloa cartel. The move comes after years of pressure from Shareaction and El Chapo which co-ordinated 15 investment firms with 24bn of assets under management in its campaign. Exemplifying HSBCs role in the drug trade is a United States government Deferred Prosecution Agreement that confirmed that between 2006-2010 the Sinaloa Cartel. Drug cartels earn an estimated 60 billion a year from trafficking in the United States according to the United Nations.

By Narcomappingmx Between 2006 and 2010 the Mexico arm of global banking giant Hongkong and Shanghai Banking Corporation Limited HSBC laundered 881 million USD for the Sinaloa Cartel in Mexico and the Norte del Valle Cartel in. HSBC knowingly helped Mexican cartels launder billions lawsuit claims. HSBC closed the suspected accounts but the bank kept accepting dollar deposits in Sinaloa.

The FinCEN Files raise new questions about the US. The families of several US citizens killed at the hands of some of Mexicos most notorious drug cartels are suing HSBC claiming the bank can be held. Drug cartels earn an estimated 60 billion a year from trafficking in the United States according to the United Nations.

According to a report by Mexicos Attorney Generals Office which is apparently based partly on Drug Enforcement Administration DEA. The suit alleges that the three attacks were made possible because HSBC knowingly allowed the Los Zetas Juarez and Sinaloa cartels along with the Colombian Norte del Valle cartel. Justice Departments decision in 2012 to forgo indicting HSBC or any bank executives in the Sinaloa cartel case.

HSBC sued over Mexico drug cartel murders. HSBC the cartel bank said it expects to provide between 750bn 540bn and 1trn to support coal-based art and a fully staffed Sinaloa Cartel basketball team. A man weraing a pig nose and holding fake notes shouts slogans during a protest in front of a HSBC branch building in.

Much of the money swilling into HSBC from the cartel came through an apparently small exchange house. Between 2006 and 2008 HSBCs Mexican unit moved 11 billion from Sinaloa to the banks US. HSBC closed the suspected accounts but the bank kept accepting dollar deposits in Sinaloa.

The Sinaloa Cartel headquartered on Mexicos northern Pacific Coast is constantly exploring new ways to launder its gargantuan profits. Near a hangar recently revealed to belong to the Sinaloa cartel. Between 2006 and 2008 HSBCs Mexican unit moved 11 billion from Sinaloa to.

Branches according to the documents. HSBC - The Banking Choice for Cartels and Money Launderers. HSBC closed the suspected accounts but the bank kept accepting dollar deposits in Sinaloa.

The Sinaloa Cartel reportedly used its HSBC bank accounts to transfer money for the purchase of a turboprop aircraft painting a picture of the kind of financial transactions the cartel was able to carry out thanks to lax international banking controls. Between 2006 and 2008 HSBCs Mexican unit moved 11 billion from Sinaloa to the banks US branches according to the documents.

Awash In Cash Drug Cartels Rely On Big Banks To Launder Profits Parallels Npr

Hsbc Dirty Money And White Collars Insight Crime

Hsbc Dirty Money And White Collars Insight Crime

Mapping Sinaloa Cartel Operatives In Juarez Battleground Insight Crime

Hsbc Bank Plc The Preferred Financial Institution For Drug Cartels And Money Launderers Cornell International Law Journal

Hsbc Dirty Money And White Collars

What Should I Know About Mexico S Drug Cartels Drug Cartel And History

Hsbc Sued Over Mexico Drug Cartel Murders Financial Times

Business Ethics Case Analyses Hong Kong And Shanghai Banking Company Fraud And Money Laundering 2007 2015

Hsbc Knowingly Helped Mexican Cartels Launder Billions Lawsuit Claims Fox News

Hsbc Will Pay 1 9 Billion For Money Laundering

Hsbc Moved Suspicious Money After Paying A Record Fine For Money Laundering Aml Real Estate

The world of regulations can seem like a bowl of alphabet soup at instances. US money laundering laws are not any exception. Now we have compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Risk is consulting firm centered on defending monetary companies by lowering danger, fraud and losses. We've massive financial institution expertise in operational and regulatory danger. Now we have a robust background in program management, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many antagonistic consequences to the organization as a result of risks it presents. It will increase the chance of major dangers and the chance price of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment